Enthused by the developments shaping the payment industry and passionate about demystifying the hype surrounding the payments complexity, Paypr.work was founded in early 2022, with the ambition to empower businesses such as Fintechs and merchants with relevant payments knowledge to help them navigate the ever-changing payment systems effortlessly and manage their operations strategically.

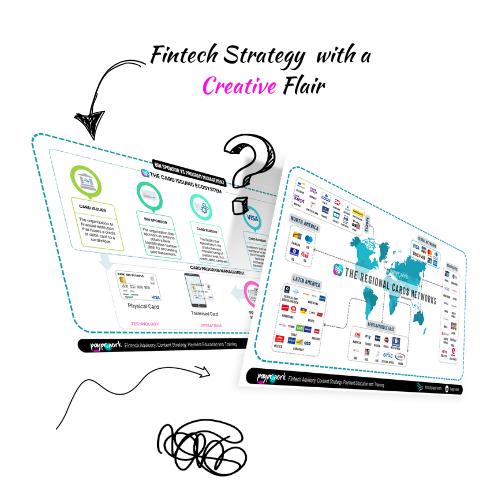

Drawing upon our payments expertise combined with a creative approach, Paypr.work [ˈpeɪpəwəːk] brings a fresh perspective to strategic thinking and problem-solving. This dynamic blend allows Paypr.work to deliver distinctive value to our clients, whether through our advisory services, payment implementation projects or the creation of thought leadership content.

How Did We Get Here?

You may have seen us on LinkedIn and wondered who we are. Paypr.work started out in 2022 as a payments consultancy.

Driven by 15+ years of industry experience and the significant misconceptions that exist, our first infographic was simply a way to illustrate some of the confusion we had perceived around core processing concepts and to pose questions to the industry, inviting opinions.

This sparked an unexpected and immediate surge of attention that drove organic demand for content creation, visual design, and creative work.

New Demands, New Services

Far from being just payment enthusiasts and creative adepts who coincidentally produce catchy deliverables, we are strategic enablers and content architects that approach our clients requirements with a problem solving mindset to develop strategies that unlock new opportunities!

We’re not just another consultancy, and we’re far from being simply payment enthusiasts or creative minds producing catchy deliverables. At our core, we are strategic enablers and content architects. We approach our clients’ needs with a problem-solving mindset, crafting strategies that unlock new opportunities, redefine product positioning, and align with ambitious business goals.

How is it Going?

Today, our core offerings focus on three areas: consultancy, payment education, and thought leadership.

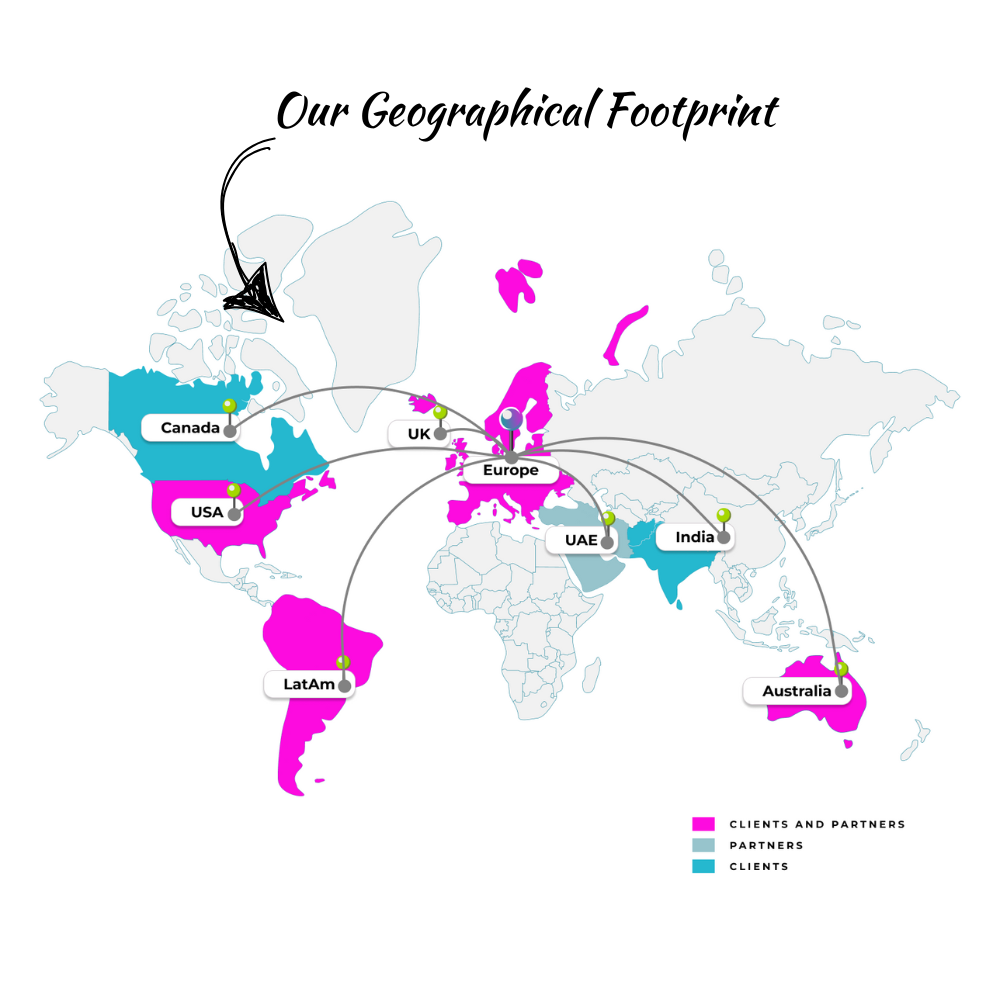

We’ve had the privilege of working with ambitious leaders and startups across Europe, the US, Canada, Australia, and now India. Checkout.com, Shift4, Iberojet, and Visa are just a glimpse of the incredible projects we’ve been trusted with.

The most incredible part? All of these works originated primarily from inbound interest. We’ve been working on everything from advising on strategy and sourcing new tech partners to educating teams on the nuances of the travel vertical and architecting technical content and design work.

What’s our Difference?

Authenticity. Boldness. Insatiable Curiosity.

Paypr.work team seamlessly blends creative production with deep payments expertise. It’s a unique combination where strategic insight meets hands-on execution. This fusion allows us to authentically tell our clients’ stories with bold creativity and genuine understanding of the payments landscape.

Through our unique approach to content creation and storytelling—grounded in real operational expertise—we bring a fresh perspective that captures attention and drives impact.

Consulting

Expert guidance to optimise payment systems and enhance financial processes.

Strategy

Comprehensive strategies to streamline and improve payment operations.

Project Management

Full end-to-end payment implementation and integration.

Orchestration

Coordination of complex payment solutions involving multiple systems and stakeholders

Optimisation

Improving the efficiency and cost-effectiveness of payment processes.

Research

In-depth research to provide insights on payment trends and innovations.

Market Monitoring

Monitoring payment industry developments to identify strategic opportunities and risks.

Payment 101

Introductory course covering the basics of payment systems and processes.

Payment 202

Advanced course delving deeper into complex payment concepts and technologies.

Learning Programmes

Tailored learning programmes designed to meet specific business needs.

Workshop

Interactive sessions providing hands-on experience in payment systems.

Blogging

Regular educational blog posts on the latest trends and best practices in payments.

Webinar

Online seminars focused on current payment industry topics and innovations.

Industry Reports

Detailed reports providing insights and analysis on payment industry trends and forecasts.

Content Creation

High-quality content rooted in deep industry knowledge, ensuring relevance and authority with intended target audiences.

Visuals

Simplified visuals that effectively convey complex payment concepts with clarity and impact, enhancing storytelling and audience engagement.

Thought Leadership

A curated process to develop strategic assets and content that not only strengthens the products positioning but also establish authority in the industry.

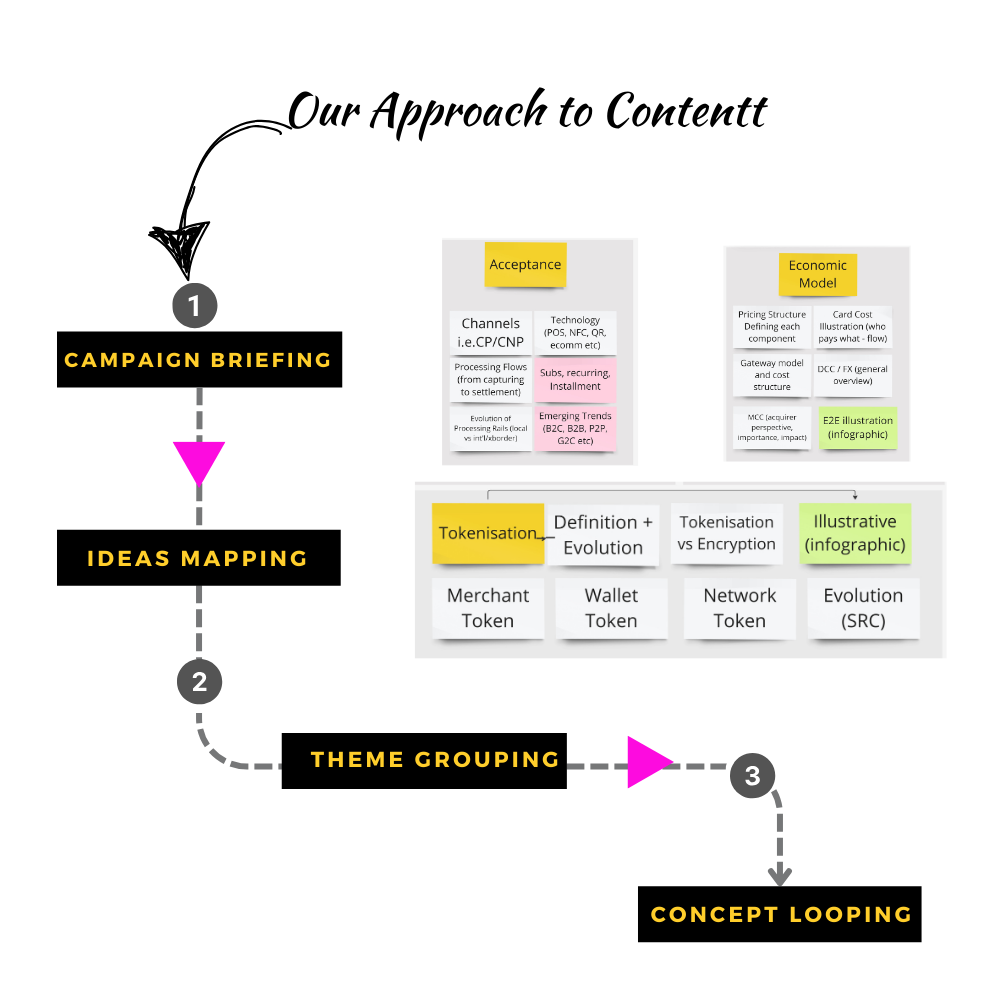

Content Ideation

A collaborative process supported by industry strategists to bring diverse and creative direction to payment-related content.

Production

Large-scale projects and programmes involving extensive production efforts, and complex campaign architecture and coordination.

Community

Fostering an organic and engaged community through authentic and strategic content interaction.

Analytics

Measuring and analysing content performance to inform and refine strategy.

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

Our passion for payments fuels our commitment to sharing knowledge and collaborating closely with an extensive network of trusted advisors, consultants, strategists, and ISO/MSPs hailing from diverse industries. As such, we always welcome the opportunity to work alongside other independent consultants because we value diverse perspectives. We believe in fair collaboration and know first-hand that true expertise is built on experience. If you like the sound of collaboration and teamwork, we would love to get further acquainted. Please get in touch.

As a payments agnostic business, we always welcome the opportunity to work alongside other independent agents, ISOs, consultants or experts in the industry. We have a fair approach to collaboration and are driven by a genuine drive to collaborate, share and leverage expertise from a community of likeminded individuals.

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.