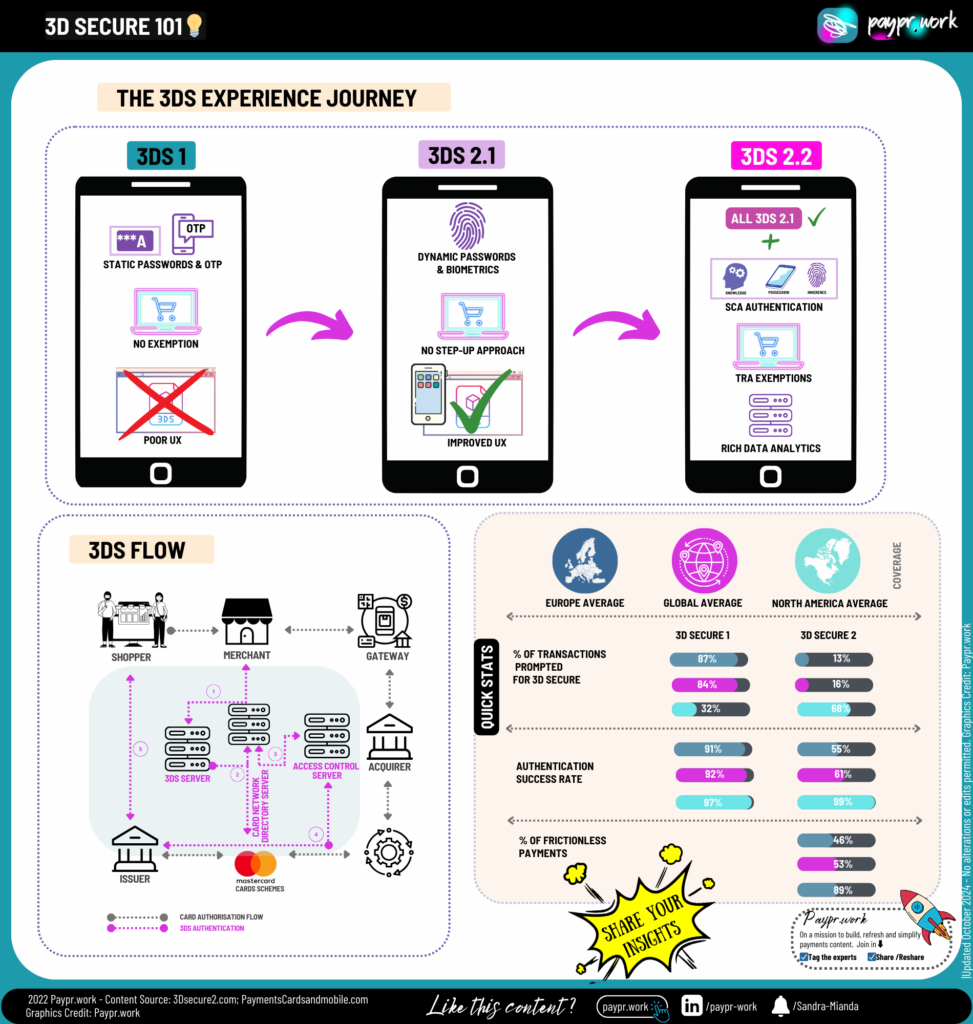

#3DS is a standard that was introduced in the payment industry in 2001 as a step to mitigate #ecommerce #fraud. The approach was somehow clunky, with:

⬇️ a redirect to a web browser or pop up that looked not short of fraudulent😁,

⬇️ a poor mobile #ux, adding terrible #friction,

⬇️ a catch-all approach prompting the authentication on 🄰🄻🄻 ecommerce transactions,

⬇️ which inevitably led to an increase in #shopping #cartabandonment.

The latest version of 3D Secure, commonly referred as 3DS v2, was introduced in late 2019 to address new demands and some of the frictions that v1 caused. V2 gave room to:

✅ dynamic authentication,

✅ stronger security at the checkout

✅ the flow of richer data capture within the chain

✅ a risk-based authentication approach

✅ dynamic waivers controlled by the merchant, the acquirer and or the issuer

With 3DS2, #merchants have the ability to send far more data to the issuing bank than with 3DS1. With the extra #data, issuers can then apply #frictionless authentication to approve a transaction without requiring any manual input from the cardholder for low-risk transactions or trusted party [Transaction Risk Analysis referred as #TRA]

A 2021 report on #authentication from Ravelin Technology, outlined that:

💡The US were the quickest to rollout #3DS2 multi-factor authentication protocols

💡68% of transactions in the US use 3DS2, with a significant 99% authentication success rate.

💡Globally, an average of 16% of payments use 3DS2, with an average authentication rate of 55%.

💡Europe has the highest authentication rate at 99%, however with only 13% of the transactions using 3DS2.

A couple of key notions that took off with 3DS2 are:

📌Delegated authentication, whereby the issuers can allow for a third-party to do the authentication i.e. the merchant, an acquirer or a digital wallet provider.

📌Decoupled Authentication, whereby a merchant can verify the customer’s identity and authenticate the transaction through a different channel, such as a mobile #pushnotification inside the customer banking app or by email or through any other channel the issuer bank opts for to request the #payment consent from.

👉🏽𝙋𝙖𝙮𝙢𝙚𝙣𝙩𝙨 𝙚𝙭𝙥𝙚𝙧𝙩𝙨, 𝙨𝙝𝙖𝙧𝙚 𝙮𝙤𝙪𝙧 𝙞𝙣𝙨𝙞𝙜𝙝𝙩𝙨🎤

—–

𝙇𝙞𝙠𝙚 𝙩𝙝𝙞𝙨 𝙘𝙤𝙣𝙩𝙚𝙣𝙩?

🚀On a mission to build, refresh and simplify payments content🔍. 📨Get in touch, let’s collab💫Paypr.work [Consultancy • Training • Content Strategy]

☑️Consultancy – We Talk Payments🤓

☑️Training – We Demystify the Complex🤯

☑️Content Strategy – We Unpack your Core Value🚀

For an opportunity to collab on a FREE infographic, contact: intro@paypr.work

#paymentsinfographics #cocreation #colearning #cosharing #tagtheexpert #payment101 #payprwork

— Paypr.work Disclaimer – The views and opinions expressed in this article are those of the Paypr.work author, writer or researcher and do not necessarily reflect the official policy or position of Paypr.work as a company. The visuals included are simplified representations meant for personal learning and should not be construed as official guidance or endorsement. They are not intended as promotional material unless explicitly stated otherwise. Please use this content for informational purposes only, should you require consultation or wish to use our material for purposes beyond personal learning, please get in touch with us directly at members@paypr.work.

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.