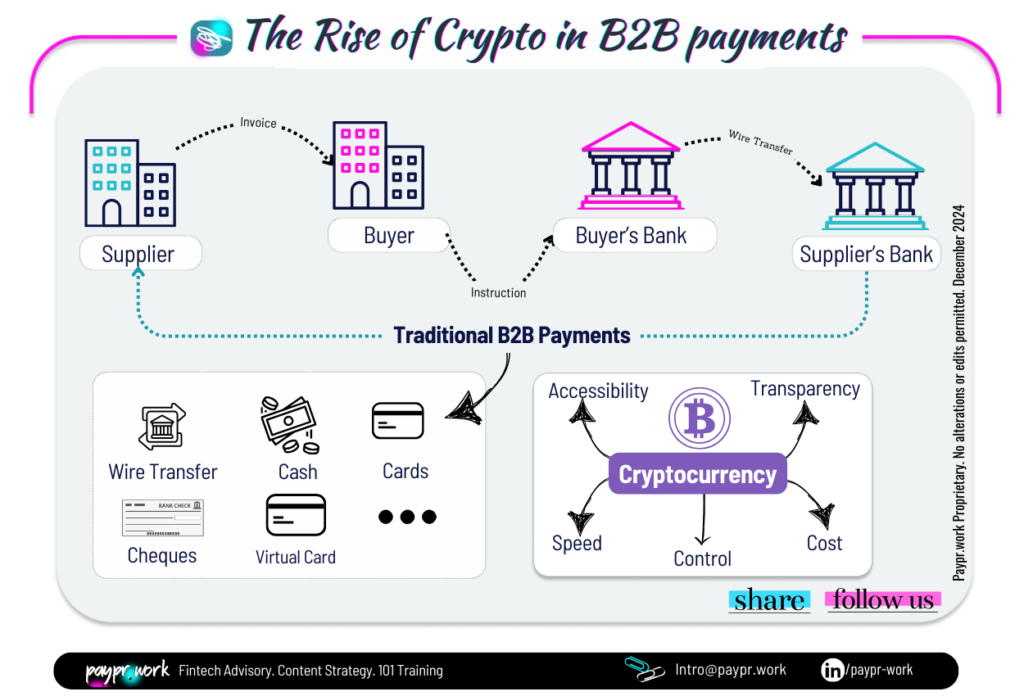

Cryptocurrency is no longer just a niche asset class or a speculative investment. Its growing adoption in business-to-business (B2B) payments is disrupting traditional banking models, which have faced fluctuating exchange rates, longer processing times, and inefficient cross-border payment. Moreover, the transaction fees incurred with these traditional methods are high, which calls for a modern, centralised, efficient, quick, and secure payment system with lower transaction fees. The process of B2B payments is more complex compared to B2C payments, as it involves a longer settlement time that can take days or even weeks to complete. This is due to the need for meticulous approval and verification procedures for each transaction. In contrast, B2C payments usually happen instantly, simplifying the transaction process.

Cryptocurrencies have shifted from speculative investments to practical tools, particularly in B2B payments due to its potential and possible applications, forcing financial institutions to adapt to a rapidly evolving landscape. For banks, understanding the implications and opportunities of crypto in B2B payments is critical to staying competitive in the global financial ecosystem. A recent survey by GoodFirms highlights the factors driving businesses toward this emerging technology. Foremost is the growing acceptance of cryptocurrencies, with 82.2% of companies noting its increasing legitimacy among global enterprises. This widespread adoption, supported by regulatory clarity and institutional interest, has created a network effect, making digital assets more practical for large-scale financial operations.

1. Increased Speed of Transaction with Improved Efficiency

This is without doubt a highly obvious benefit of Crypto. As stated earlier, with third parties involved in other B2B payments, processing large sums would usually require days to weeks before completion and so is time-consuming. Cryptocurrency transactions, on the other hand, are settled almost instantaneously on the blockchain, this ensures rapid access to funds. Hence this also promotes the finalisation and conclusion of deals and this significantly improves the sum of revenues and expenditures over time and its proper management. Unlike traditional methods like ACH payments, which can take days, cryptocurrencies enable seamless, real-time fund transfers.

2. Connections and Communications to New markets and industries

B2B companies can interact and engage with new markets and industries effectively, especially those on the blockchain because Cryptocurrency provides access to them through its network on the blockchain technology. This comprises sectors like cryptocurrency exchanges, the web3 industries, and NFTs. Businesses that transact with cryptocurrency align themselves with the modern preferences of their counterparts in various advanced sectors at the forefront, potentially increasing their capacity and establishing new growth opportunities.

3. International Transactions without Banking Barriers

Cryptocurrency saves the day yet again in industries operating in countries where the banking systems are still developing as it presents a priceless solution. This is evident in many African countries. Organisations can transact without restrictions from banks, promoting fluid and more dependable international transactions. It is said that this particular benefit of crypto is greatly beneficial in Oil and Gas, where large sums are involved and transactions often occur in not easily accessible regions.

4. Decreased Transaction Cost

This goes without saying that traditional banking services have increased transaction costs as the fees significantly impact the cost of transacting. Whereas Crypto reduces transaction costs by up to 25% and offers savings of 75%, this makes it economically endearing, especially for an organisation looking to reduce expenditures.

5. Enhanced Transparency

Users can observe any transaction done in real-time and blockchain technology promotes more transparency by enhancing system security and user confidence.

While the benefits are clear, banks must also navigate several challenges before fully integrating crypto into their B2B payment systems:

The regulatory landscape for cryptocurrency varies widely across jurisdictions. Banks must ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, which can be challenging in a decentralised ecosystem.

The price volatility of cryptocurrencies like Bitcoin and Ethereum makes them less suitable for B2B payments without proper hedging mechanisms. Stablecoins pegged to fiat currencies offer a solution but require oversight to ensure their stability. Cryptocurrencies in 2022 were the trend, surging in their use as a method of payment, but within a year, they plunged, losing much of their value and many exchanges that support them have also faced legal issues and almost complete collapse.

Because of its volatile nature, it is not always possible to know how much to charge for a crypto payment using US dollars and so the market is based on speculation as the market value for a currency can increase or decrease within the time it takes to pay an invoice in full. So having little knowledge of how to manage such volatility could damage working relationships and cripple businesses.

Crypto transactions are irreversible, which could pose risks for businesses in the case of fraud or payment errors. From time immemorial, Crypto has been extensively linked to many criminal organizations. Crypto being focused on anonymity has become deficient in details that would normally be provided in a B2B transaction.

Also, Crypto has been a victim of many cyber-crimes, security breaches, and hacks that have led to a loss of millions of dollars, and it becomes more tragic because these losses are not insured and as such are most times irrecoverable.

Integrating crypto payments into existing banking systems requires significant investment in infrastructure, including blockchain interoperability, digital wallet integration, and customer support training.

IBM uses the Stellar blockchain for its cross-border payment solution. This partnership enables businesses to conduct near-instantaneous, low-cost transactions in multiple currencies, including stablecoins.

Visa has partnered with Circle, the issuer of USDC, to enable stablecoin payments. Businesses can now settle transactions in real-time using USDC on Visa’s network, bypassing traditional banking delays.

MicroStrategy, a leading enterprise software firm, uses Bitcoin for supplier payments in jurisdictions with limited access to banking systems. Between October 31, 2024, and November 10, 2024, MicroStrategy acquired approximately 27,200 bitcoins for $2.03 billion in cash, with an average purchase price of $74,463 per bitcoin, inclusive of fees and expenses. This substantial investment underscores the company’s belief in Bitcoin as both a payment tool and a long-term asset.

There is an increasing use and delving into digital currencies and there would be no stopping it. For banks to be able to maintain their profitability still and generate revenue, they would need to adopt shifts in their strategies that could accommodate and maintain a high level of profit. The adoption of blockchain technology and the security measures in place will enable a speedier transaction than those provided by the traditional, cumbersome payment methods.

As another step, banking firms should protect their consumers and ensure regulatory compliance by developing rules and protocols for digital currencies. In this way, consumers can rest assured when conducting business using digital currencies.

Crypto’s surge in B2B payments has many benefits that assist businesses in evolving into greater companies and a few drawbacks that could be remedied to provide the best services. Banks must see these areas in which Crypto excels and take necessary steps to promote a more satisfied consumer base.

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.