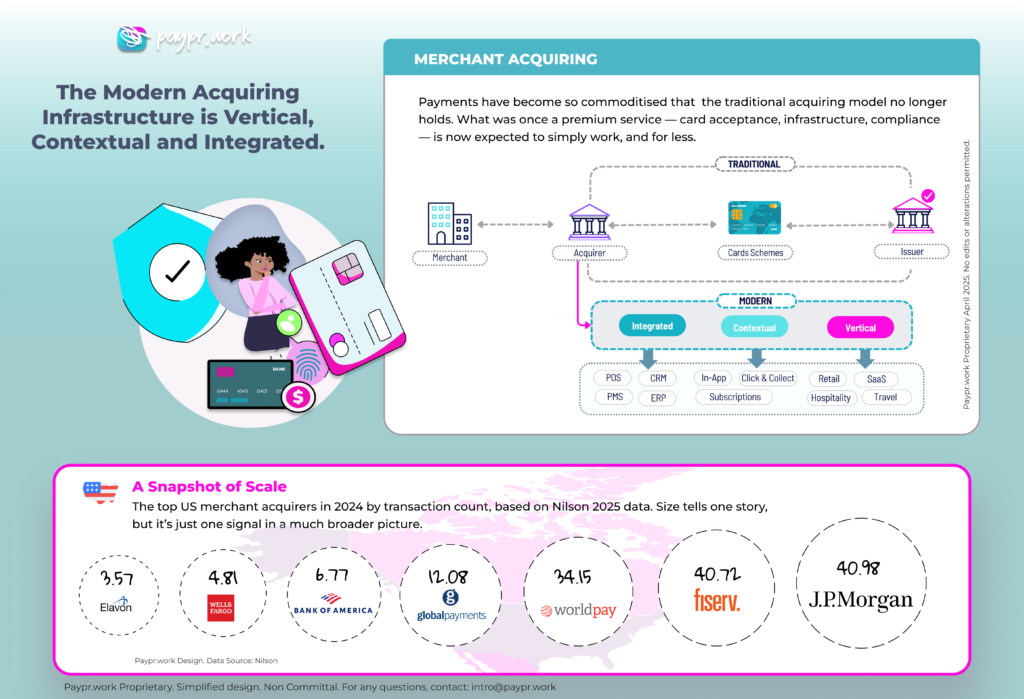

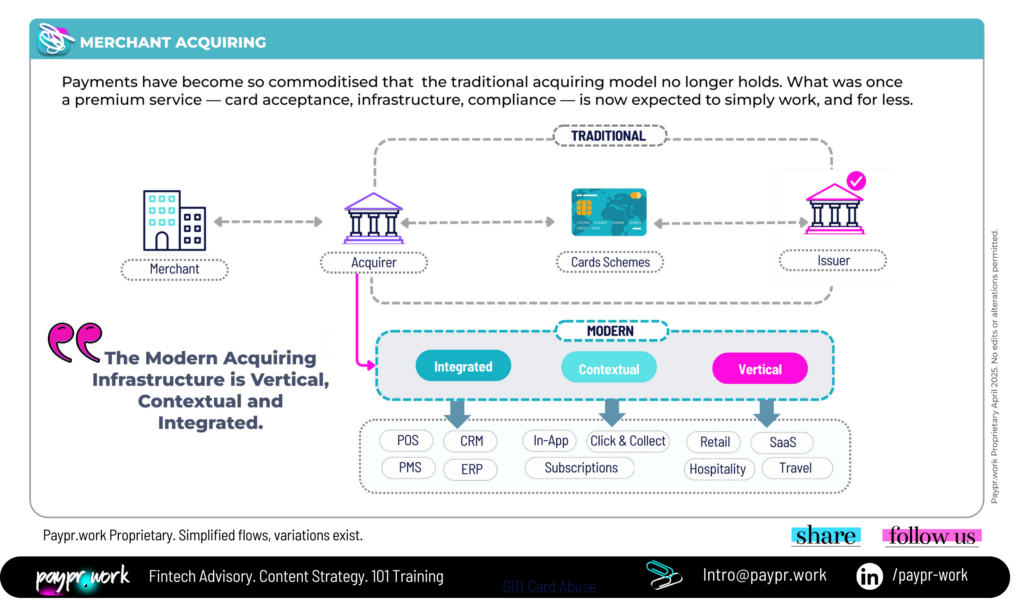

The sad reality about payments is that they have become so much commoditised that the traditional acquiring model no longer holds.

Merchants no longer view acquiring as a value-added relationship — but as infrastructure. The pressure is no longer on getting access, but on making that access invisible, reliable, and cheap. Payments are no longer the differentiator — they’re the expectation.

What was once a service merchants paid a premium for i.e. card acceptance, infrastructure, compliance, is now expected to 𝘫𝘶𝘴𝘵 work. And to work 𝘧𝘰𝘳 𝘭𝘦𝘴𝘴.

Large merchants have the scale, volume, and leverage to negotiate acceptance fees down to razor-thin margins, sometimes to the point where the cost of acceptance becomes almost negligible. For these merchants, payments have become a cost of scale, not a cost of doing business. Acquirers compete fiercely for their business, often sacrificing margin in exchange for volume, brand association, or access to broader service opportunities. In many cases, the commercial viability for the acquirer is wafer-thin, sustained only by hopes of cross-sell or long-term retention.

Meanwhile, smaller merchants operate in a very different reality.

Many don’t have a dedicated payments resource or internal expertise to question what they’ve been sold. They often overpay for basic services, lack visibility into fee structures, and have limited access to customisation or support. The irony? Many don’t realise what’s missing, or what’s possible, until they outgrow their provider. By then, they’ve already absorbed years of unnecessary cost and friction.

This disparity reflects a broader imbalance in the market where payments can either be a strategic lever or a silent drain, depending entirely on the merchant’s size, awareness, and who’s sitting across the table.

In 2025, acceptance is expected, reliability is assumed, and merchants, particularly digital-native or omni-channel businesses don’t perceive value in the transaction alone. Pricing pressure has intensified, margins have collapsed, and the traditional acquirer-merchant relationship has fundamentally changed.

Traditional acquirers once controlled the core infrastructure of payments but today many risk fading into the many interchangeable components in a stack they neither designed nor meaningfully influence. Platforms like Shopify, Toast, and Stripe rewrote the rules by embedding payments into tools merchants actually use i.e. CRMs, booking systems, storefronts etc…

The market is demanding infrastructure that connects payments, data, diverse payment methods, channels, customer experience, fraud, and loyalty integrating seamlessly into the merchant’s broader business operations, while remaining modular and flexible, 𝘳𝘢𝘵𝘩𝘦𝘳 𝘵𝘩𝘢𝘯 prescriptive or monolithic.

It’s no longer 𝘫𝘶𝘴𝘵 about access or integration. It’s about giving merchants ownership and control with autonomy, balanced with the transparency to understand performance across the stack, the agility to adapt, and the intelligence to optimise and grow.

The infrastructure itself should feel 𝘪𝘯𝘷𝘪𝘴𝘪𝘣𝘭𝘦.

What matters is the 𝐯𝐚𝐥𝐮𝐞 it enables, how that value is delivered, and the quality of relationship it fosters. The impact is driven by relevance, adaptability, and operational performance.

Today, much of the innovation are emerging where the infrastructure is:

Today, much of the meaningful innovation [𝘢𝘯𝘥 𝘵𝘩𝘦 𝘳𝘦𝘢𝘭 𝘸𝘪𝘯𝘯𝘦𝘳𝘴 𝘐𝘔𝘖 ] are emerging where infrastructure isn’t just functional, but intentional. It’s being built not to serve everyone, but to serve the right things well, with purpose, context, and alignment.

🔹 Vertical by design

↪️ Native to merchant operations — designed with the realities of each industry in mind, from workflows to integrations to compliance.

🔹 Contextual by default

↪️ Orchestrating smarter flows — adapting in real time to optimise outcomes based on behaviour, risk, intent, or channel.

🔹 Embedded in the way merchants actually operate

↪️ Creating relevance, not dependency — supporting merchants within their ecosystem, not locking them into yours.

This is what modern infrastructure must deliver: not rigid rails or off-the-shelf solutions, but adaptive systems that evolve with the merchant not against them. It scales because it flexes. It performs because it understands the context, not just the code. And it endures because it’s built around the merchant’s business, their workflows, their goals, their customer journey, rather than forcing them to reshape around someone else’s model.

In this new reality, merchants aren’t looking for access; they already have it. They’re looking for enablement, the kind that gives them ownership without technical debt, control without rigidity, and intelligence without overload. They expect infrastructure that integrates seamlessly, operates invisibly, and adds value continuously. And they want partners who empower, not gatekeep.

Because in the end, it’s not the infrastructure that defines the merchant, it’s how well the infrastructure responds to who the merchant is becoming.

#PaymentExperts, in that context, who do you think is leading the acquiring space these days? 🎤

—

𝐍𝐞𝐞𝐝 𝐡𝐞𝐥𝐩 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮𝐫 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐨𝐫 𝐩𝐫𝐨𝐝𝐮𝐜𝐭 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲?

👉🏽Let’s talk: intro@paypr.work

𝐋𝐨𝐨𝐤𝐢𝐧𝐠 𝐟𝐨𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐥𝐞𝐚𝐫𝐧𝐢𝐧𝐠 𝐫𝐞𝐬𝐨𝐮𝐫𝐜𝐞𝐬?

👉🏽Check out our unique hub: https://lnkd.in/dKsmxGnT

🖇️ Follow Paypr.work [ˈpeɪpəwəːk] for more weekly #paymentinsights #paymentinfographics

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.