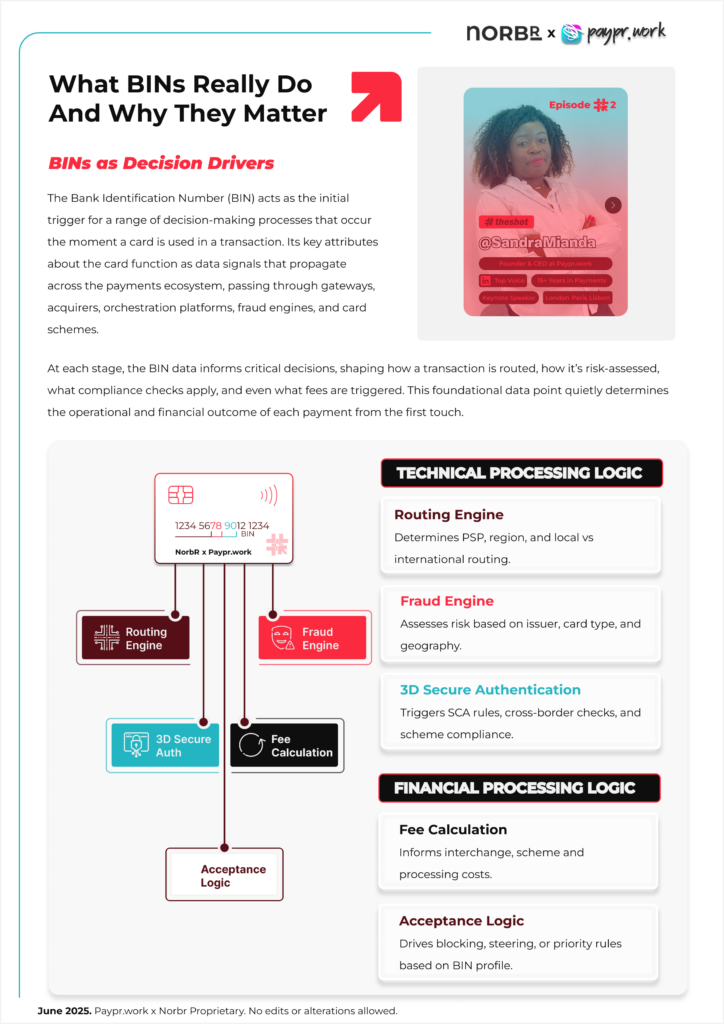

This week’s episode 2 of #TheShot examined how a single BIN (Bank Identification Number) can trigger distinct behaviours across multiple layers of the payments stack. While often reduced to a routing prefix, the BIN carries structured intelligence that informs both technical and financial decisioning throughout the lifecycle of a transaction.

At the most immediate level, BIN data activates responses across two core functional domains:

These layers may appear distinct but do not operate in isolation. Each is shaped by the data embedded within the BIN itself, from card type and issuing entity to country of origin and scheme affiliation. This interconnectedness is what makes BIN logic so foundational. It is the first signal in a transaction that influences how the payment is scored, where it is sent, and how much it will cost.

On the issuing side, BINs are used to define card programme structures and portfolio segmentation. They underpin the commercial positioning of a product, for example, enabling issuers to offer differentiated pricing, benefits, and controls to specific customer segments or geographies. A BIN can represent a consumer debit product in one market, and a high-rebate corporate charge card in another.

In the acquiring space, the same BIN data drives fee application, scheme compliance, and routing logic. Whether a transaction qualifies for regulated interchange or triggers a cross-border surcharge often depends on what the BIN reveals. Acquirers leverage this intelligence to optimise processing paths and maintain compliance across different card schemes and regulatory zones.

For merchants, the implications are operational and immediate. BINs determine not only whether a card is accepted but also the cost and risk associated with it. A merchant working across regions may see wide fluctuations in processing fees based solely on the BIN mix of their customer base. BIN data also feeds into fraud systems and can influence business rules, such as blocking prepaid cards, rerouting commercial volumes, or prioritising low-cost acceptance routes.

In essence, the BIN is more than a six- or eight-digit number, it is the gateway to the commercial and operational parameters of every transaction.

Next week, we’ll be turning to practical use cases, diving into how merchants can use BIN classification to flag misrouted traffic, reduce high-cost acceptance, and strengthen the intelligence behind their payment flows.

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.