Online vs offline may seem like 2 generic terms but there are amongst some of the most confused terms in payments. They mean different things, whether you talk to a customer, a product expert or a commercial person… No pun intended😁😅!

Understanding payments is all about grasping the nuances and applicable context so let’s clear this:

𝗢𝗻𝗹𝗶𝗻𝗲 𝘃𝘀 𝗢𝗳𝗳𝗹𝗶𝗻𝗲 𝗖𝗵𝗮𝗻𝗻𝗲𝗹𝘀

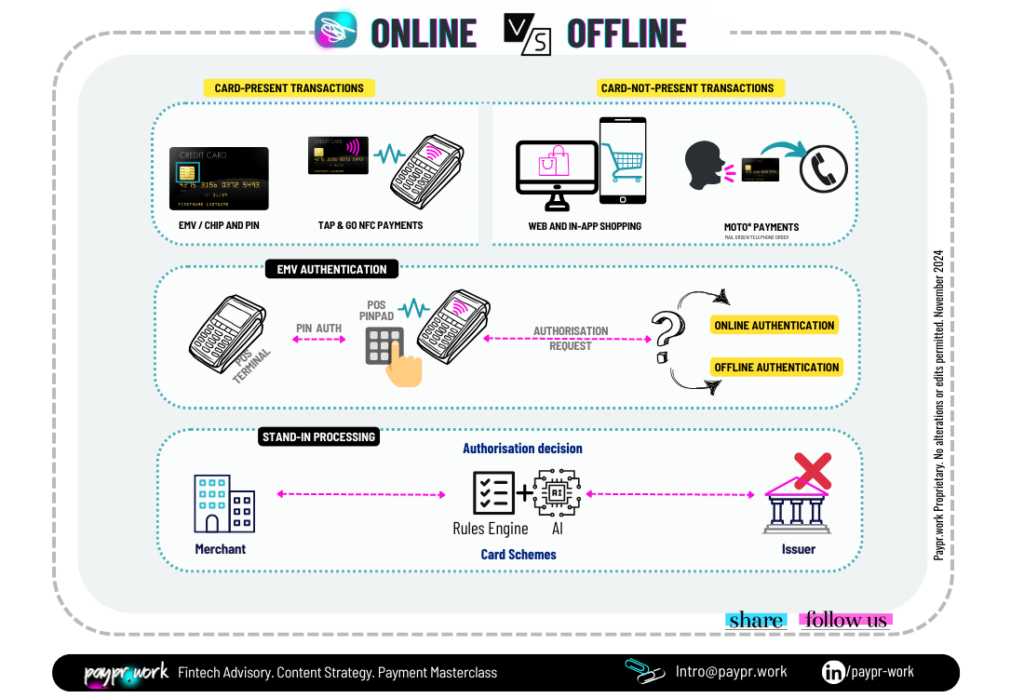

◾The online and offline channels generally refer to Card-Not-Present (CNP) transactions for online activities and Card-Present (CP) transactions for in-person, offline purchases.

◾ A CP transaction is one where the #electronicdata is captured at the time of the sale through mag stripe, EMV, contactless, Apple Pay.

◾All other type of transactions are deemed CNP even if the customer is physically present with the card at the time of the transaction, for example when the card is keyed into a terminal it is effectively a CNP transaction or in industry jargon a MOTO transaction [ Mail Order Telephone Order].

𝗢𝗻𝗹𝗶𝗻𝗲 𝘃𝘀 𝗢𝗳𝗳𝗹𝗶𝗻𝗲 𝗔𝘂𝘁𝗵𝗲𝗻𝘁𝗶𝗰𝗮𝘁𝗶𝗼𝗻

◾Also referred as #EMV PIN online vs offline.

◾ In the offline PIN scenario, the card actually stores the PIN securely on the chip itself, so the verification can occur through static or dynamic data authentication between the card and the terminal.

◾The online authentication uses dynamic cryptogram to verify a transaction through to the issuer.

𝗢𝗻𝗹𝗶𝗻𝗲 𝘃𝘀 𝗢𝗳𝗳𝗹𝗶𝗻𝗲 𝗔𝘂𝘁𝗵𝗼𝗿𝗶𝘀𝗮𝘁𝗶𝗼𝗻

◾An authorisation is when the merchant submits a transaction request to the issuing bank (cardholder’s bank), who will determine if the transaction should be approved or denied. The issuing bank will decide after verifying that the cardholder has the appropriate funds or credit in their account.

◾The authorisation request can be decisioned by the issuer/processor/scheme and is deemed to be an online transaction. Offline transactions usually are those not authorised. These could be transactions approved by the chip or any transaction that goes straight to clearing without going through authorisation first.

◾𝗦𝘁𝗮𝗻𝗱-𝗶𝗻 𝗽𝗿𝗼𝗰𝗲𝘀𝘀𝗶𝗻𝗴 is a service provided by the card schemes, in which they act on behalf of the issuer in the authorisation decision making at times when the processor is unable to authorise the transactions.

👉🏽#Paymentexperts, any perspectives to share on #online vs #offline #payments and #transactions🎤?

—

𝑾𝒐𝒏𝒅𝒆𝒓 𝒘𝒉𝒐 𝒘𝒆 𝒂𝒓𝒆?

𝘞𝘦 𝘢𝘳𝘦 𝘢 𝘵𝘦𝘢𝘮 𝘰𝘧 𝘗𝘢𝘺𝘮𝘦𝘯𝘵𝘴 𝘚𝘵𝘳𝘢𝘵𝘦𝘨𝘪𝘴𝘵𝘴 𝘣𝘭𝘦𝘯𝘥𝘪𝘯𝘨 𝘰𝘶𝘳 𝘪𝘯𝘥𝘶𝘴𝘵𝘳𝘺 𝘦𝘹𝘱𝘦𝘳𝘵𝘪𝘴𝘦 𝘸𝘪𝘵𝘩 𝘢 𝘤𝘳𝘦𝘢𝘵𝘪𝘷𝘦 𝘢𝘱𝘱𝘳𝘰𝘢𝘤𝘩 𝘵𝘰 𝘢𝘴𝘴𝘪𝘴𝘵 𝘰𝘶𝘳 𝘤𝘭𝘪𝘦𝘯𝘵𝘴 𝘵𝘩𝘳𝘰𝘶𝘨𝘩 𝘊𝘰𝘯𝘴𝘶𝘭𝘵𝘪𝘯𝘨, 𝘚𝘵𝘳𝘢𝘵𝘦𝘨𝘺, 𝘙𝘦𝘴𝘦𝘢𝘳𝘤𝘩 𝘢𝘯𝘥 𝘛𝘩𝘰𝘶𝘨𝘩𝘵 𝘓𝘦𝘢𝘥𝘦𝘳𝘴𝘩𝘪𝘱 𝘱𝘳𝘰𝘫𝘦𝘤𝘵𝘴.

⏭ Follow Paypr.work [ˈpeɪpəwəːk]

⏭ Visit https://www.paypr.work/

⏭ Sign up to learn more: https://lnkd.in/dVXjGkzB

#paymentinfographics

#payprwork

Paypr.work blends payment knowledge and custom research into a simplified yet insightful narration. Our narratives feature visually engaging designs that break down both fundamental and complex payment jargons into bite-sized, repetitive micro-concepts to promote better comprehension and retention.

Sign up for a Paypr.work Premium Membership to exclusively access all of our payment resources, including our full articles, industry insights, ecosystem maps, reports, videos, and our unique library of bespoke infographics.

Don’t miss out— sign up to learn payments in a captivating way!

You have provided so much light and knowledge in a fascinating world. You definitely bring the fun to Fintech like no one else and actually know what you are talking about! Thanks goodness for you😁!

Vice President Global Product Expansion, Shift4

Impressive, congratulations Sandra and Team Paypr.work. The detail in each of your 100+ infographics is outstanding and showcases your expertise well… Continued success for this remarkable work!

LinkedIn Strategist | Digital Transformation Leader

Host of Heads Talk

Your diagrams have the ability to explain the most complicated of topics in way that can be understood by anyone. Not many people have the ability to create self-explanatory visuals, so keep doing your magic 🔥🔥🔥!

CEO & Co Founder of CLOWD9

Your content is so informative, accurate, and fabulously presented in infographics that always attract great attention. Your visuals naturally spark strong engagement regardless of the LinkedIn algorithms !

B2B Marketing, Marqeta

The depth of Paypr.work knowledge and skill sets are truly impressive. Their ability to combine deep industry expertise with well-depicted visual is pretty unique. I strongly recommend Sandra and Paypr.work !

Director EMEA Payment Solutions, Marriott International

👏👏 👏👏 👏👏 I always love your content and in fact, I am so happy for all of us in the industry… we’re lucky to have you sharing your payment wisdom with us 🤓… thank you! Keep up the great work.

Strategic Accounts Director, Truelayer | Payments and Fintech Geek

Merci Sandra pour ta facilité à vulgariser le paiement via de simples dessins, qui me surprendront toujours. Pour ceux qui ne connaissent pas son travail, je vous invite à suivre Paypr.work [ˈpeɪpəwəːk]!

Product Manager Paiement, Maisons du Monde

Your enthusiasm and ability to simplify Payments is so refreshing and literally shines through! Sandra and her team research, write content and create some stunning infographics for the payments industry….

Chief Operations Officer, Clowd9

Keep up the good work and know that your hard work and dedication is so inspiring for all of us. You are truly doing an incredible job and your consistent efforts don’t go unnoticed.

Chief Community Officer, NORBr | Redefining Payment Infrastructure | Linkedin Top Voice

Your posts are a masterclass in how payments have evolved from a basic utility to a strategic asset. Your ability to simplify this complexity and provide strategic direction along with implementation support is so invaluable. The clarity and depth you provide are exactly what this fast-evolving industry needs.

Chief Commercial and Operations Officer, Soffid

The mechanics of all things payment are a black box for most industry stakeholders. With the help of their well researched and designed infographics, Sandra and her team at Papr.work demystify complex flows and create awareness about the factors that play a role in the end to end processes.

Paul van Alfen | Managing Director Managing, Up in the Air - Travel Payment Consultancy

Your Paypr.work subscription gets you full access to all Paypr.work content in 1 place including: our weekly new payments articles, our infographic blog, exclusive discounts on all the services that Paypr.work has to offer and the opportunity to collaborate on free infographic to promote your knowledge/value proposition and more. The content is for personal use and cannot be copied, reproduced, redistributed, altered, modified, shared publicly or with third-party nor can derivatives of the work be created. The user may share content that is available through the free blog access subject to crediting Paypr.work with the attributions.